What's going on with SilverSun Technologies ($SSNT)?

The true value of Brad Jacobs' new investment vehicle

So if you listen to the Invest Like The Best podcast like I do, you would’ve come across the episode featuring Brad Jacobs that was released in mid November 2023. I had no idea who Brad Jacobs was prior to listening to the episode, but very quickly, I learned he’s a business legend.

Jacobs started his career in the oil brokerage business and eventually went on to build several multi-billion dollar businesses in the waste management, equipment rental, and transportation/3PL industries. Notably, he founded United Waste Systems in 1989, a consolidator of waste management companies, which he sold to Waste Management in 1992 for $2.5B. He then went on to form United Rentals in 1997, a publicly traded equipment rental company with a market cap of ~$37B today. In 2011, he invested $150M for a 71% interest in XPO, a transportation and 3PL provider. Today, XPO has a ~$10B market cap, and over the last couple of years, XPO has spun off GXO Logistics (~$7B market cap) and RXO (~$2.6B market cap). Needless to say, he has an incredibly impressive track record, and as I was listening to the podcast episode, I couldn’t help but think to myself, “wouldn’t it be nice to invest in his next venture?”

A few weeks after the podcast episode aired, my grandmother called me and said “I just bought this company called SilverSun Technologies. A friend told me to buy it.” Naturally curious, I did a quick Google search and quickly learned that Brad Jacobs had announced that he, alongside an investor group, will be acquiring SilverSun (ticker is SSNT) to effectively use as a shell company to build a multi-billion dollar company in the building products industry. I thought to myself, “No way! What are the odds that after just learning about this legend Brad Jacobs, I can actually invest in his new company out of the gate? Surely an easy multi-bagger!”

Here’s some background on the deal:

SSNT is a reseller of software solutions and consultant to mid market companies in North America

Immediately prior to the Jacobs announcement, SSNT had a market cap of $19.3M

One day prior to the closing of Jacobs’ investment, SSNT stockholders will receive shares of SSNT’s business by way of a spin-off along with a $2.5M dividend to be funded from Jacobs’ investment. In addition, prior to closing the investment, the company will effect an 8:1 reverse stock split

Upon closing the investment, Jacobs Private Equity (JPE), Jacobs’ investment vehicle, alongside minority co-investors, will invest $1B in cash into SSNT, with JPE injecting $900M and co-investors injecting $100M to pursue acquisition opportunities in the building products industry. In addition, Jacobs will become CEO and chairman of the board, and the company will be renamed QXO

The $1B investment will be structured as voting, convertible preferred stock, convertible into 219M shares at a price of $4.57 per share post-split (or $0.57 pre-split)

On top of the $1B investment, JPE and co-investors will receive 219M warrants exercisable for proceeds of ~$1.6B. The warrants are structured as follows:

109.5M warrants exercisable at a price of $4.57 per share post-split (or $0.57 pre-split)

54.75M warrants exercisable at a price of $6.85 per share post-split (or $0.86 pre-split)

54.75M warrants exercisable at a price of $13.70 per share post-split (or $1.71 pre-split)

The closing date of the investment has not been announced yet, but is likely to occur at some point in 2024. Within one year of closing the investment, Jacobs expects the new, standalone building products company to achieve at least $1B of run-rate revenue, and at least $5B within three years

So where does this leave current SSNT shareholders? When you boil it down, today’s SSNT shareholders are receiving three things:

The legacy SSNT business by way of a spin off, which as mentioned, immediately prior to the Jacobs announcement, had a market cap of $19.3M

A $2.5M dividend to be funded from the initial $1B investment

A 0.15% to 0.30% stake in QXO depending on the conversion of the warrants. Assuming no conversion of warrants, this amounts to 0.30% of $997.5M in cash ($1B less the $2.5M dividend), or $3M

That brings SSNT’s total theoretical/economic value today to nearly $24.8M. In effect, Jacobs paid SSNT stockholders a ~28% premium ($24.8M divided by $19.3M) to acquire the company.

So where has SSNT traded since the announcement?

Immediately following the Jacobs announcement on December 4th, SSNT’s stock shot up from $3.67 to $12.49, and has since rallied to $21.98. What does this mean for SSNT shareholders? Let me break it down for you:

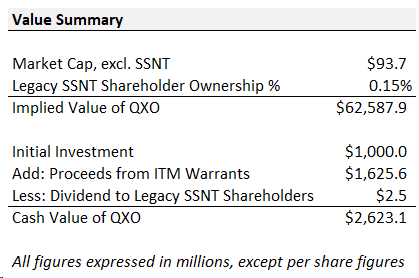

At the latest share price of $21.98, SSNT has a market cap or $115.5M. When you net off the value of SSNT’s business, which we’ll assume is $19.3M (based on the market cap of SSNT immediately prior to the Jacobs announcement), plus the $2.5M dividend, you’re left with $93.7M. You can think of this amount as the value of SSNT’s shareholders’ stake in QXO. After accounting for the 8:1 reverse stock split, this implies a post-split share price of $142.67 (or pre-split price of $17.83).

At the post-split share price of $142.67, all warrants will be deep in the money. Assuming conversion of all warrants, SSNT shareholders will own 0.15% of QXO.

As outlined below, at 0.15% ownership, $93.7M amounts to an implied value of QXO of nearly $63B. However, once SSNT is spun off, all QXO will have to its name is Brad Jacobs and $2.6B in cash! How can this make sense? Jacobs is surely worth a premium given his track record. I could probably rationalize paying the equivalent of a little over $2.6B in implied QXO value to invest behind him, but unless my math is way off, I can’t come remotely close to making sense of the current share price! At a $21.98 SSNT share price, Jacobs would have to increase equity value nearly 25 fold just to breakeven!

So now that we have established that SSNT is likely way overvalued, what share price might make sense then?

After giving effect to the spin off and dividend, SSNT’s market cap should (in theory) equate to the value of its stake in the cash Jacobs and co-investors are injecting into the company (assuming no extra credit for Jacobs’ track record), which as established above amounts to $3M. As outlined below, this point of equilibrium is met at a current (pre-split) share price of around $4.71. To break it down, at this share price, SSNT would have a market cap of $24.8M (which is in line with the theoretical/economic value established above). Once you net off the value of SSNT’s business ($19.3M) and the dividend ($2.5M), you’re left with a post-spin and post-dividend value of $3M, equating to a post-split share price of $4.54. At this post-split share price, all warrants would be out of the money, leaving SSNT shareholders with a 0.30% stake in QXO. At a $3M market cap, this implies a QXO value of $997.5M, which compares with a cash value of $997.5M (remember that at this share price, there are no cash proceeds received from warrants).

Based on the above analysis, it would appear that SSNT is currently overvalued by a factor of more than 4.5x (or has nearly 80% downside from the current share price of $21.98).

I’m not entirely sure why SSNT has traded up to its current level, but I have a few theories:

The math to arrive at a reasonable price for SSNT is not straightforward. Given the complexity and small market cap, people may be blindly buying the stock to invest behind Jacobs without understanding the full set of circumstances

Given the stock’s initial pop on December 4th, technical traders may be pushing up the price based on momentum trading strategies

I would relish the opportunity to invest behind Jacobs, but I hope by this point, I have helped readers understand what exactly they are buying when investing in SSNT today.

Disclaimer:

Please note that the above write up does not represent investment advice and has been presented for information purposes only. The information contained above has been prepared based on publicly available information and independent research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein represent the author’s own opinion and are subject to change without notice. This write up should not be relied upon as a basis for investment.

Fantastic article. I listened to the podcast and I was about to work out the numbers to see it made sense. It seems like public shareholders of the current SSNT have very little stake in QXO's enterprise.. Hopefully the valuations can adjust and make more sense in the future.

If by increase in share count you are referring to in-the-money warrants, yes the analysis does factor it in.